tax abatement definition government

Chapter 381 of the Local Government Code allows counties to provide incentives encouraging developers to build in their jurisdictions. Tax abatements are an agreement between the government and property owners where the government offers to reduce the amount of property tax bills for a specific.

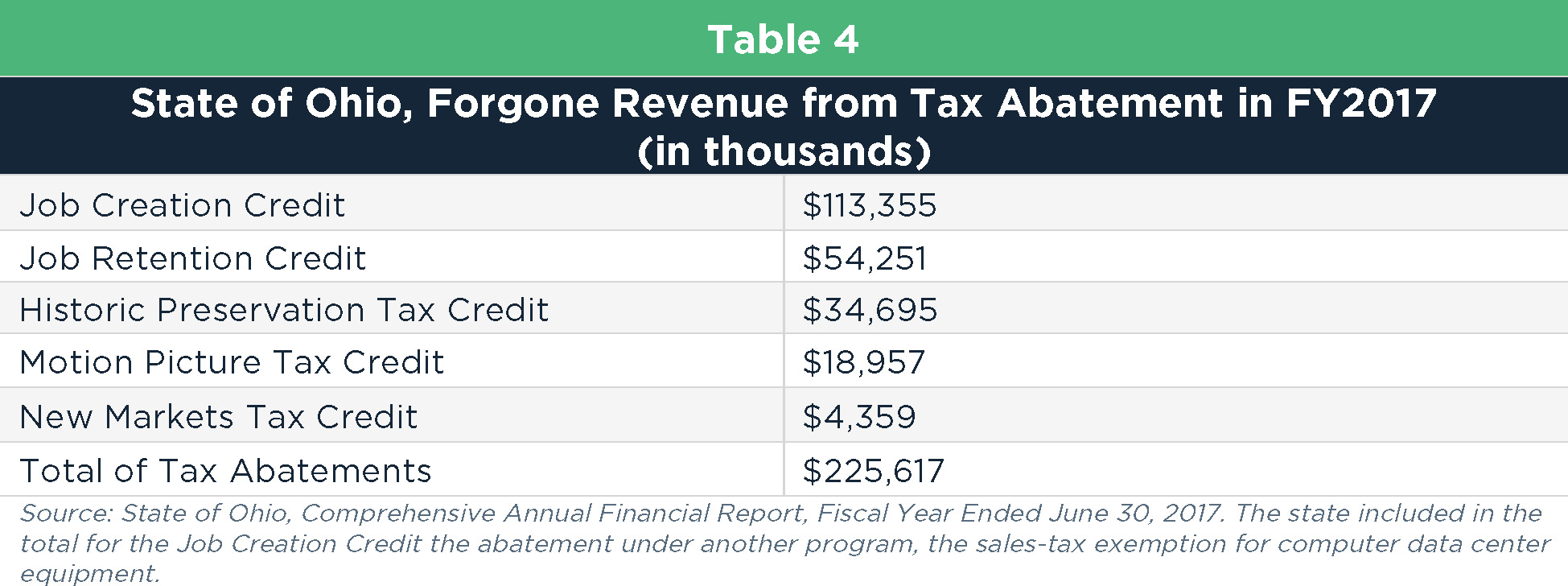

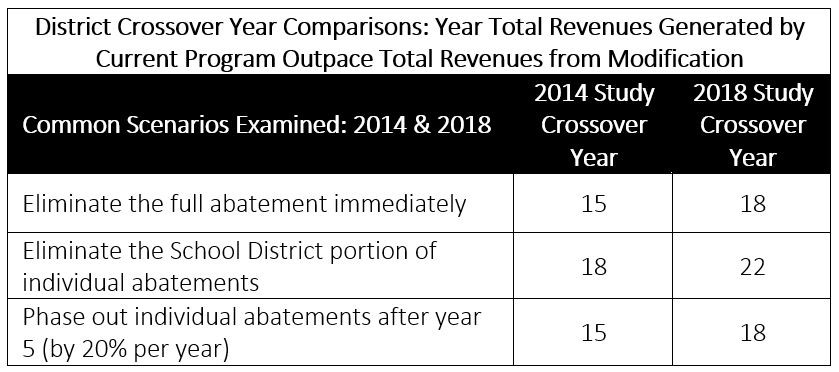

Local Tax Abatement In Ohio A Flash Of Transparency

For example if a Building Permit was issued in March 2017 the tax abatement application must be submitted to the City of Cleveland on or before November 1 2018.

. What Is a Tax Abatement. Chapter 9C of Title 40 also known as the Brownfield Development Projects gives cities and counties the authority to abate the following taxes. A In this section abatement period means the period during which all or a portion of the value of real property.

Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. Abatement is a reduction in the level of taxation faced by an individual or company. The contact number for.

DEFERRAL OF COMMENCEMENT OF ABATEMENT PERIOD. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount.

Ad Valorem Tax. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate. Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file.

An abatement is a tax break offered by a state or local government on certain types of real estate or business opportunities. Such arrangements are known as tax abatements. A governing body may use an abatement sometimes called a tax.

77 Tax Abatement Disclosures that will require those state and local. Tax Abatement Definition. A reduction of taxes for a certain period or in exchange.

Recently the GASB published GASB Statement No. A county may administer and develop a program to. An ad valorem tax is based on the assessed value of an item such as real estate or personal property.

A tax abatement is when your tax obligations are reduced and in some cases eliminated for a certain period of time. The most common ad valorem taxes are property taxes. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development.

Non-educational county and city sales and. Typically property tax abatement is offered by a local government such as at a state or municipal level as an incentive for property owners. By reducing or eliminating.

In other words when your taxes are abated it. What are Tax Abatements. Tax Abatement Meaning.

Examples of an abatement include a tax decrease a reduction in penalties or a. A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase in the value of the real property andor tangible personal property from.

:max_bytes(150000):strip_icc()/GettyImages-1351333930-c16be1d0252a4a798f08cfb753f744fb.jpg)

Taking Advantage Of Property Tax Abatement Programs

Property Tax Abatement Program

Tax Abatement Exposes Contention At West Lafayette Council Meeting

New York City S Solar Property Tax Abatement Ends Soon Solar Com

.png)

Property Tax Abatement Program

What Is A Tax Abatement Should You Buy A Home With One Localize

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How To File For A Personal Property Tax Abatement Boston Gov

Appealing Property Taxes How To Challenge Your Tax Assessment

Nyc Residential Property Tax Guide For Class 2 Properties

Local Tax Abatement In Ohio A Flash Of Transparency

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-10-13at3.19.54PM-6fce7c82c61441f490ce6ff571f25896.png)